Not-So-Common Business Activities That Offer VAT Recovery Opportunities

February 5, 2019

Bilal Ahmad

Common practice in the recovery of VAT in the UK has been to manually go over paper invoices and purchase receipts to provide solid proof of reclaimable VAT to HM Revenue and Customs (HMRC).

But since many businesses and individuals find the recovery of tax to be a complex, time-consuming process, few people and businesses have given in-depth attention to the types of goods and services that offer VAT recovery opportunities.

Many such opportunities have instead flown under the VAT savings radar.

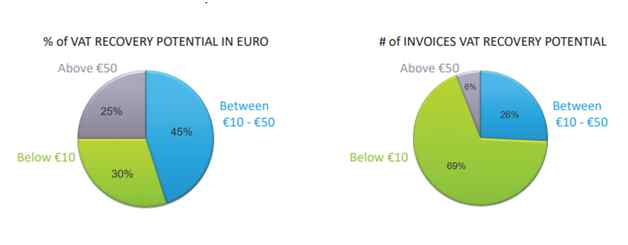

A VATBox Benchmark, under VAT Recovery Potential, showed 69% of travel and entertainment (T&E) invoices are below Euro 10 reclaimable VAT. To many businesses, the seemingly tiny savings potential makes manually checking and validating such invoices seem like not worth the effort.

Yet, such expenses cover a significant 30% of VAT recovery potential.

So, what are some examples of activities you could be training your VAT recovery efforts on to reclaim the most?

Note that while you can claim a VAT refund paid for goods and services bought for use in your business, if you use the supplies for both business and personal uses, you can only reclaim VAT on the proportion used for business only.

Conferences

According to the VATBox Benchmark report, money spent on conferences is the third-largest T&E expense. Conference costs come after accommodations at 43% and restaurants at 19%. They hold VAT recovery potential if they are strictly business expenses.

Purchases Made Before VAT Registration

According to the HMRC, you can claim VAT paid on an item you bought years ago before VAT registration.

But backdating is limited to 4 years for physical items and 6 months for services. For goods, you still have to have them or have the goods the original ones were used to make.

Do note that a business needs to have registered for VAT to claim VAT recovery.

0n-Street Meter Parking

To recover VAT on business mileage, you may already know you are required to keep a receipt showing the VAT sustained in purchasing fuel.

Now, you can recover VAT on on-street meter parking. To do that, a business must have a valid tax receipt or invoice showing a VAT registration number. If that is unavailable then there would be no solid proof of reclaimable VAT.

Reclaim VAT on Purchases of GBP 25 or Less

You can successfully complete a VAT recovery plan by claiming it from purchases that do not have a receipt for proofing. There is a caveat, though. You’d be able to make that happen by, for example, making payments using a coin-operated machine. In order to benefit from this, you have to ensure that the supplier of the machine is VAT registered.

Reclaim VAT Even When the Invoice Shows Someone Else’s Details

Let’s take an example.

If an invoice shows your employee’s details, yet the purchase of goods or services was for your business’ use, you can reclaim VAT despite your name missing on the invoice. Remember, only the business or person who received the supply can claim VAT recovery.

Knowing some of the less popular VAT recovery opportunities in your line of business can help you save more money and spend less on VAT expenses.

Over to you.